Sales tax的会计处理和计算 | ACCA Cloud

摘要:大家好,很多同学都会分不清到底什么是Sales tax,怎么计算,怎么进行会计处理,所以今天就主要给大家讲解一下S...

大家好,很多同学都会分不清到底什么是Sales tax,怎么计算,怎么进行会计处理,所以今天就主要给大家讲解一下Sales tax的知识点:

01 What is sales tax

●间接税(不由本人直接缴纳的税)

●基于商品和服务的销售价格进行征收

(ie.Sales tax=List price*税率)

●增值税的缴纳者为商品的最终消费者,但是是由销售商品的企业在卖商品时向消费者除了货款外额外代收一笔增值税,由企业集中交给税务局,Sales tax对企业来说是一笔应付账款,可理解为应付增值税,是负债类科目。

●分类:

02 Calaulation of sales tax

Sales tax=inclusive of sales tax(Gross amount)/(1+tax rate)×tax rate=exclusive of sales tax(Net amount)×tax rate

Sales tax payable=output sales tax–recoverable input sales tax

03 Accounting Treatment of sales tax

根据英国的税收系统基本框架结构及其部门设置,可将主线分为两条。一边是负责做事情的财政部Her Majesty’s Treasury,另一边是负责监管的皇家检察署Crown Prosecution Service(CPS)。

●对于在税局登记过的公司来说(Tax registered):

1)Sales时收到的Output sales tax是代税局收的,最终还要交还给税局,所以这部分Output sales tax不能记入Sales,而是当做一笔Sales tax payable,而这笔Output sales tax对公司来说仍然是应收账款,所以Trade receivable中的金额仍然包含Sales tax,也就是

Dr Trade receivable(含税)

Cr Sales tax payable

Cr Sales(不含税)

2)Purchase时支付的Input sales tax是税局是会退税的,所以这部分Input sales tax不能记入Purchase,而是当做一笔Sales tax receivable,而这笔Input sales tax对公司来说仍然是应付账款,所以Trade payable中的金额仍然包含Sales tax,也就是:

Dr Purchase(不含税)

Dr Sales tax receivable

Cr Trade payable(含税)

●对于没有在税局登记过的公司来说(Non tax register),就直接按含税金额记录,不用考虑Sales tax:

1)Sales:

Dr Trade receivable

Cr Sales

2)Purchase

Dr Purchase

Cr Trade payable

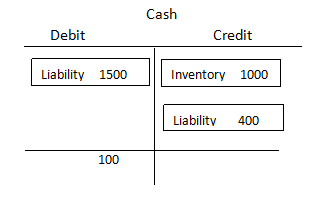

●T账

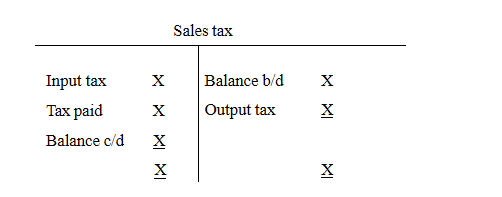

04 Sales tax payable movement

Opening sales tax payable+output tax-input tax-tax paid=Closing sales tax payable

05 Zero rated and exempt goods

●大多数商品和服务均按标准税率缴纳增值税,但有些商品被称为零税率(zero rated)或免税商品(exempt goods)。

●如果商品的税率为零(zero rates),则应按0%的税率征收增值税。

●免税的商品(exempt goods),企业无法注册增值税,因此无法收回其购买所付的进项税。

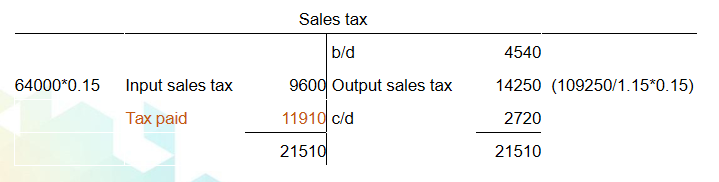

06 例题

The following information relates to Ava Co's sales tax for the month of March 20X3:

Sales(including sales tax)$109,250

Purchases(net of sales tax)$64,000

Sales tax is charged at a flat rate of 15%.Ava Co's sales tax account showed an opening credit balance of$4,540 at the beginning of the month and a closing debit balance of$2,720 at the end of the month.

What was the total sales tax paid to regulatory authorities during the month of March 20X3?

解析:考察Sales tax的Movement的计算:

Opening sales tax payable+output tax-input tax-tax paid=Closing sales tax payable

Opening sales tax payable=4540(Cr);

Closing sales tax payable=-2720

(期末余额与T账中期末值方向相反,期末余额在Dr方,则T账中的期末值(c/d)在Cr方,且借方余额表示负的应付账款,所以是-2720);

Output sales tax(销售产生的)=109250(含税金额)/(1+15%)*15%=14250;

Input Sales tax(采购产生的)=64000*15%(不含税金额)=9600;

所以本期Tax paid=Opening sales tax payable+output tax-input tax-Closing sales tax payable

=4540+14250-9600-(-2720)=11910

以上就是我们Sales tax的内容~