摘要:文丨高顿Nini老师 *ACCA学习帮原创版权所有,未经授权不得以任何形式转载或抄袭,侵权必究! 再送大家一个2019ACCA资...

文丨高顿Nini老师

*ACCA学习帮原创版权所有,未经授权不得以任何形式转载或抄袭,侵权必究!再送大家一个2019ACCA资料包,可以分享给小伙伴,自提,戳:ACCA资料【新手指南】+内部讲义+解析音频

今天,Nini老师应帮主的邀请给大家讲解一下FR科目非常易错的三道题,很有代表性,建议大家认真看文末的视频,弄懂相关的考点。

第一道题目是和无形资产有关的题目。第二道题目是和IAS 41有关的题目。第三道题目是和合并报表中留存收益有关的计算。

题目1

1.Which of the following statements relating to intangible assets is true?

A.All intangible assets must be carried at amortised cost or at an impaired amount;they cannot be revalued upwards

B.The development of a new process which is not expected to increase sales revenues may still be recognised as an intangible asset

C.Expenditure on the prototype of a new engine cannot be classified as an intangible asset because the prototype has been assembled and has physical substance

D.Impairment losses for a cash generating unit are first applied to goodwill and then to other intangible assets before being applied to tangible assets

对应解析

讲这道题的关键在于很多学生会对第2点产生疑惑,所以老师想在这里再次和大家确认一下。

这道题题干问的是下列关于无形资产的说法哪个是正确的?

A所有无形资产必须按摊余成本或减值金额列账;他们不能重估,价值不能增加。这句话是错误的,首先不确定使用寿命的无形资产是不摊销的,其次确定使用寿命的无形资产也是可以重估增值的。所以A错误。

B预计不会增加销售收入的新流程的开发仍可被视为无形资产,也是有可能削减成本的,节约成本也相当于在带来经济利益。B正确。

C新发动机原型的支出不能归类为无形资产,这个说法是错误的,新发动机原型的支出是可以被归类为无形资产的。

D CGU减值损失首先应用于goodwill,然后应用于其他无形资产,然后再应用于有形资产。这句话是错误的,正确的应该是减值损失的分配是先分配给明显有减值迹象的个体,再给goodwill,再给non current asset。所以D选项错误。注意减值这条准则针对的是non current asset,一般长期资产,不是current asset。

题目2

2.To which of the following items does IAS 41 Agriculture apply?

(i)A change in the fair value of a herd of farm animals relating to the unit price of the animals

(ii)Logs held in a wood yard

(iii)Farm land which is used for growing vegetables

(iv)The cost of developing a new type of crop seed

which is resistant to tropical diseases

A All four

B(i)only

C(i)and(ii)only

D(ii)and(iii)only

对应解析

(i)农场的牲畜的价值用公允价值表示,这属于准则规定,这是对的。(ii)堆木厂的原木已经是产成品,harvest收割之后的产品要从IAS41转入存货计量。

(iii)生产蔬菜的土地不能归集在农业中,因为土地是固定资产。(iv)这里开发一款可以抵抗病虫害的新的种子,要归属于无形资产。

因此这道题选择B选项。

题目3

3.Wilmslow acquired 80%of the equity shares of Zeta on 1 April 2014 when Zeta’s retained earnings were$200,000.During the year ended 31 March 2015,Zeta purchased goods from Wilmslow totalling$320,000.At 31 March 2015,one quarter of these goods were still in the inventory of Zeta.Wilmslow applies a mark-up on cost of 25%to all of its sales.

At 31 March 2015,the retained earnings of Wilmslow and Zeta were$450,000 and$340,000 respectively.

What would be the amount of retained earnings in Wilmslow’s consolidated statement of financial position as at 31 March 2015?

A$706,000

B$542,000

C$498,000

D$546,000

对应解析

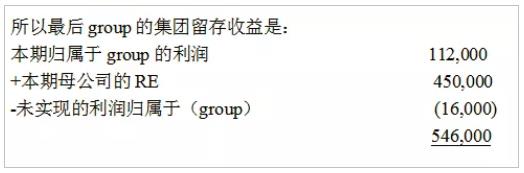

这里求的是合并报表中留存收益是多少。

合并报表中的留存收益是通过母公司从出生到现在所有的累积收益加上子公司纳入合并之后产生的归属于母公司的收益。

收购当天子公司的retained earning是200,000,年末是340,000,说明今年赚的钱是140,000,这个140,000分给group是140,000*80%=112,000

再看内部交易:母公司卖给子公司的产品中还有1/4留在仓库里面,所以有1/4的未实现的利润要减去,这里是1/4*[320,000-(320,000./(1+25%)]=16,000这里的未实现利润是归于母公司,并且注意这是母公司卖给子公司,所以不用再在NCI中分。

所以这道题选择D选项。

总之呢,学习是没有捷径的,有多少努力就会有多少回报。以下是本期内容的精讲视频,会更加清晰,请大家仔细观看,有问题可以留言,考季加油!

*ACCA学习帮原创版权所有,未经授权不得以任何形式转载或抄袭,侵权必究!再送大家一个2019ACCA资料包,可以分享给小伙伴,自提,戳:ACCA资料【新手指南】+内部讲义+解析音频

今天,Nini老师应帮主的邀请给大家讲解一下FR科目非常易错的三道题,很有代表性,建议大家认真看文末的视频,弄懂相关的考点。

第一道题目是和无形资产有关的题目。第二道题目是和IAS 41有关的题目。第三道题目是和合并报表中留存收益有关的计算。

题目1

1.Which of the following statements relating to intangible assets is true?

A.All intangible assets must be carried at amortised cost or at an impaired amount;they cannot be revalued upwards

B.The development of a new process which is not expected to increase sales revenues may still be recognised as an intangible asset

C.Expenditure on the prototype of a new engine cannot be classified as an intangible asset because the prototype has been assembled and has physical substance

D.Impairment losses for a cash generating unit are first applied to goodwill and then to other intangible assets before being applied to tangible assets

对应解析

讲这道题的关键在于很多学生会对第2点产生疑惑,所以老师想在这里再次和大家确认一下。

这道题题干问的是下列关于无形资产的说法哪个是正确的?

A所有无形资产必须按摊余成本或减值金额列账;他们不能重估,价值不能增加。这句话是错误的,首先不确定使用寿命的无形资产是不摊销的,其次确定使用寿命的无形资产也是可以重估增值的。所以A错误。

B预计不会增加销售收入的新流程的开发仍可被视为无形资产,也是有可能削减成本的,节约成本也相当于在带来经济利益。B正确。

C新发动机原型的支出不能归类为无形资产,这个说法是错误的,新发动机原型的支出是可以被归类为无形资产的。

D CGU减值损失首先应用于goodwill,然后应用于其他无形资产,然后再应用于有形资产。这句话是错误的,正确的应该是减值损失的分配是先分配给明显有减值迹象的个体,再给goodwill,再给non current asset。所以D选项错误。注意减值这条准则针对的是non current asset,一般长期资产,不是current asset。

题目2

2.To which of the following items does IAS 41 Agriculture apply?

(i)A change in the fair value of a herd of farm animals relating to the unit price of the animals

(ii)Logs held in a wood yard

(iii)Farm land which is used for growing vegetables

(iv)The cost of developing a new type of crop seed

which is resistant to tropical diseases

A All four

B(i)only

C(i)and(ii)only

D(ii)and(iii)only

对应解析

(i)农场的牲畜的价值用公允价值表示,这属于准则规定,这是对的。(ii)堆木厂的原木已经是产成品,harvest收割之后的产品要从IAS41转入存货计量。

(iii)生产蔬菜的土地不能归集在农业中,因为土地是固定资产。(iv)这里开发一款可以抵抗病虫害的新的种子,要归属于无形资产。

因此这道题选择B选项。

题目3

3.Wilmslow acquired 80%of the equity shares of Zeta on 1 April 2014 when Zeta’s retained earnings were$200,000.During the year ended 31 March 2015,Zeta purchased goods from Wilmslow totalling$320,000.At 31 March 2015,one quarter of these goods were still in the inventory of Zeta.Wilmslow applies a mark-up on cost of 25%to all of its sales.

At 31 March 2015,the retained earnings of Wilmslow and Zeta were$450,000 and$340,000 respectively.

What would be the amount of retained earnings in Wilmslow’s consolidated statement of financial position as at 31 March 2015?

A$706,000

B$542,000

C$498,000

D$546,000

对应解析

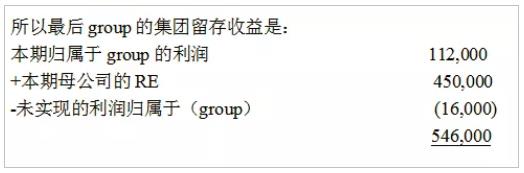

这里求的是合并报表中留存收益是多少。

合并报表中的留存收益是通过母公司从出生到现在所有的累积收益加上子公司纳入合并之后产生的归属于母公司的收益。

收购当天子公司的retained earning是200,000,年末是340,000,说明今年赚的钱是140,000,这个140,000分给group是140,000*80%=112,000

再看内部交易:母公司卖给子公司的产品中还有1/4留在仓库里面,所以有1/4的未实现的利润要减去,这里是1/4*[320,000-(320,000./(1+25%)]=16,000这里的未实现利润是归于母公司,并且注意这是母公司卖给子公司,所以不用再在NCI中分。

所以这道题选择D选项。

总之呢,学习是没有捷径的,有多少努力就会有多少回报。以下是本期内容的精讲视频,会更加清晰,请大家仔细观看,有问题可以留言,考季加油!