ACCA考试科目F3合并报表non-controlling interest介绍

- 2023年05月08日 14:55

- 作者:ACCA学习帮

- 阅读:(112)

2023ACCA备考资料

财务英语入门

历年真题答案

2023考纲白皮书

2023考前冲刺资料

高顿内部名师讲义

高顿内部在线题库

摘要:今天高顿ACCA小编给大家介绍一下ACCA考试科目F3合并报表non-controlling interest的知识点与试题解析,小编再送一个考试资...

今天高顿ACCA小编给大家介绍一下ACCA考试科目F3合并报表non-controlling interest的知识点与试题解析,小编再送一个ACCA考试资料包,可以分享给小伙伴,自提,戳:ACCA资料【新手指南】+内部讲义+解析音频

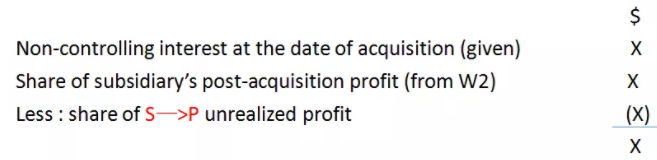

注意这里只减去包含在子公司报表中的未实现利润*NCI%,因为NCI实际上持有的是子公司的股份,分享的是子公司的利润,所以当集团内部的未实现利润是由于母公司卖给子公司商品的时候,不需要在这一步(W4)体现。

随手小测

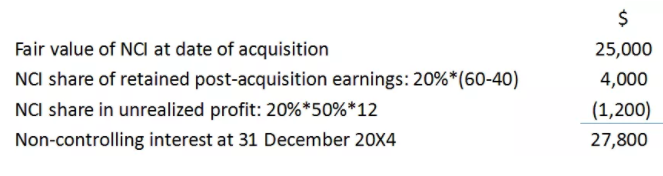

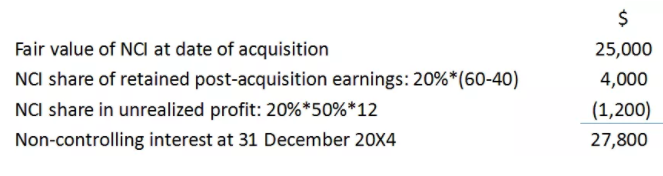

Donna Co acquired 80% of the equity share capital of Blitsen Co on 1 January 20X4 when the retained earnings of Blitsen Co were $40,000. The fair value of the non-controlling interest at this date was $25,000. At 31 December 20X4, the equity capital of Blitsen Co was as follows:

During the year Blitsen Co sold goods to Donna Co for $20,000. This price included a

mark-up of $12,000 for profit. At 31 December 20X4, 50% of these goods remained unsold in the inventory of Donna Co. What is the value of the non-controlling interest in the Donna Group at 31 December 20X4, for the purpose of preparing the consolidated statement of financial position?

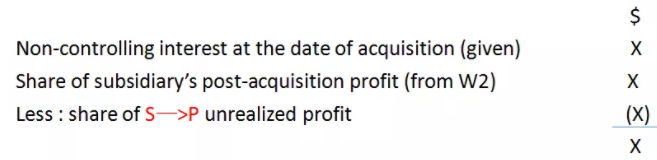

W4:non-controlling interest

18.4 AssociatesAn associate is an entity over which another entity exertssignificant influence.Associates are accounted for in the consolidated statements of a group using the equity method.

●Associates–An entity,including an unincorporated entity such as a partnership,in which an investor has significant influence and which is neither a subsidiary nor a joint venture of the investor.

●Significant influence–IAS 28 states that if an investor holds 20%or more of the voting power of the entity or

(a)representation on the board of directors of the investee

(b)participate in the policy making process

(c)material transactions between investor and investee

(d)interchange of management personnel.

(e)provision ofessential technical information

●Equity method:(IAS 28)An investment in an associate is accounted for using the equity method.Under the equity method,the investment in an associate is initially recorded at cost and the carrying amount is increased or decreased to recognize the investor’s share of the profit or loss of the investee after the date of acquisition.

Initial investment cost X

Share of profit X

(Dividends received)(X)

Investment in associate X

●Statement of financial position show the investment in associated undertakings as a non-current asset investment,stated at cost.The individual company’s income statement shows dividend income received from associates under the heading“investment income”.

Example 1:

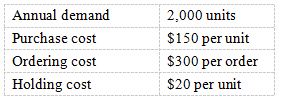

Swing purchased 80%of Cat’s equity on 1 January 20x8 for$120,000 when Cat’s retained earnings were$50,000.The fair value of the non-controlling interest on that date was$40,000.During the year,Swing sold goods which cost$80,000 to Cat,at an invoiced cost of$100,000.Cat had 50%of the goods still in inventories at the year end.The two companies’draft financial statements as at 31 December 20x8 are shown below.

Income Statement for the year ended 31 December 20x8

Required:

Prepare the draft consolidated income statement and draft consolidated statement of financial position for the Swing group at 31 December 20x8.

Solution:

SWING GROUP

Consolidated income statement for the year ended 31 December 20x8

以上就是【ACCA考试科目F3合并报表non-controlling interest介绍】的全部解答,如果想要学习更多知识,欢迎大家前往高顿教育官方网站!